Mar 2, 2022answered • expert verified A company started the year with $10,000 of inventory. Purchases for resale during the year were $20,000. Inventory on December 31 is $5,000. What’s the cost of goods sold Advertisement Expert-Verified Answer question 2 people found it helpful topeadeniran2

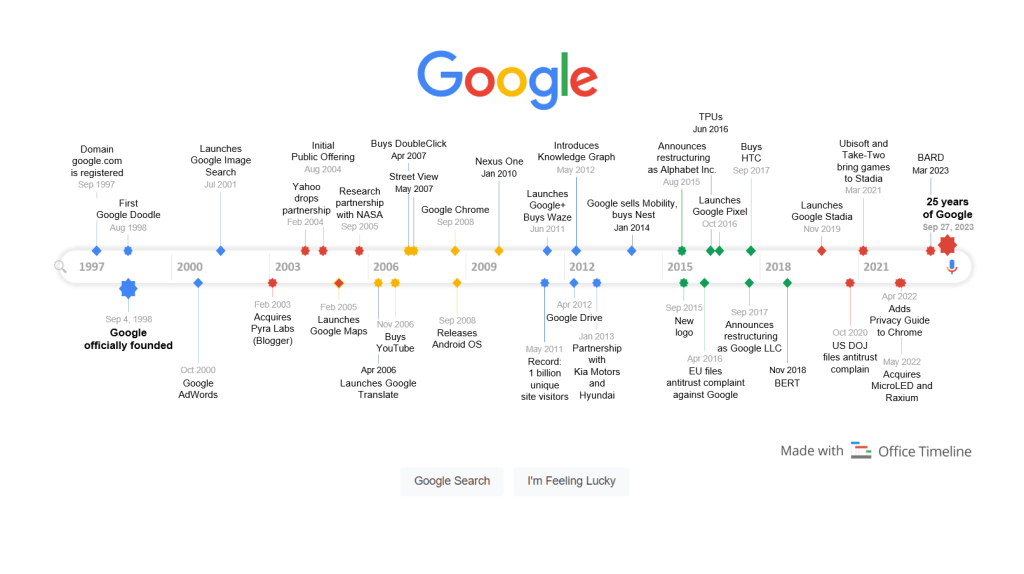

History of Google timeline

Dec 27, 2022Wardell Company purchased a mainframe on January 1, 2019, at a cost of $56,000. The computer was depreciated using the straight-line method over an estimated five-year life with an estimated residual value of $11,000. On January 1, 2021, the estimate of useful life was changed to a total of 10 years, and the estimate of residual value was

Source Image: shopify.com

Download Image

Jun 24, 2023question No one rated this answer yet — why not be the first? 😎 jaychudasama1311 The cost of goods sold for the year is $25,000. This represents the total value of inventory that the company sold throughout the year. To calculate the cost of goods sold ( COGS ), we need to consider the changes in inventory throughout the year.

Source Image: numerade.com

Download Image

A company started the year with $10000 of inventory. Purchases for resale during the year were – YouTube

Asked by ConstablePorcupineMaster845. A company started the year with $10,000 of inventory. Purchases for resale during the year were $20,000. Inventory on December 31 is $5,000. What’s the cost of goods sold?

Source Image: shipbob.com

Download Image

A Company Started The Year With 10 000 Of Inventory

Asked by ConstablePorcupineMaster845. A company started the year with $10,000 of inventory. Purchases for resale during the year were $20,000. Inventory on December 31 is $5,000. What’s the cost of goods sold?

Accounting company started the year with $10,000 of inventory. Purchases for resale during the year were $20,000. Inventory on December 31 is $5,000. What is the cost of goods sold? $5000 $10000 $25000 $30000 $35000 company started the year with $10,000 of inventory. Purchases for resale during the year were $20,000.

Ending Inventory 101: Formula & Free Calculator | ShipBob

Feb 2, 2023Question 11/12A company started the year with $10,000 of inventory. Purchases for resale during the year were $20,000. Inventory on December 31 is $5,000. Wh

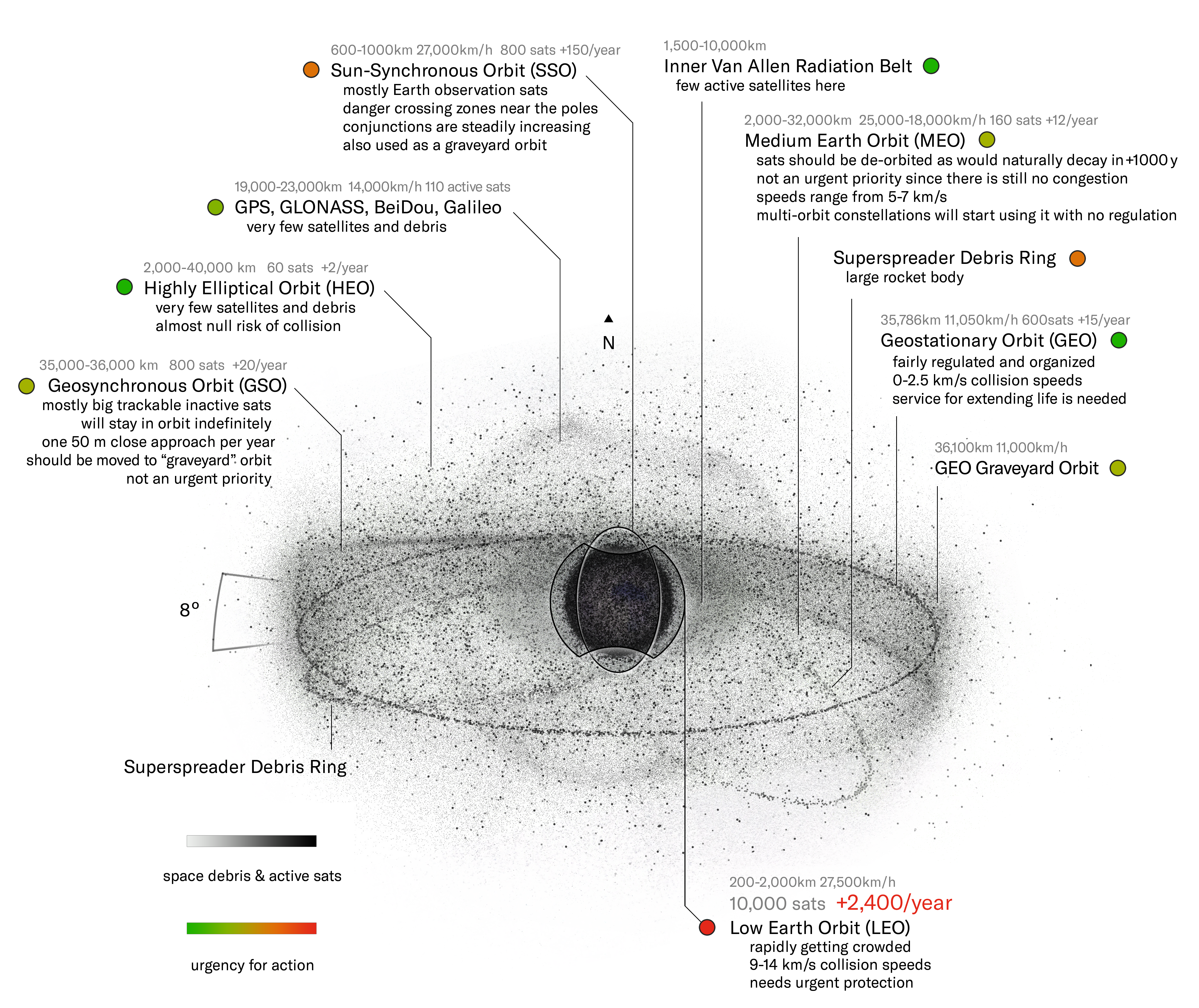

Space debris – Wikipedia

Source Image: en.wikipedia.org

Download Image

10+ Best Places to Sell Photos Online & Make Money

Feb 2, 2023Question 11/12A company started the year with $10,000 of inventory. Purchases for resale during the year were $20,000. Inventory on December 31 is $5,000. Wh

Source Image: enviragallery.com

Download Image

History of Google timeline

Jun 24, 2023question No one rated this answer yet — why not be the first? 😎 jaychudasama1311 The cost of goods sold for the year is $25,000. This represents the total value of inventory that the company sold throughout the year. To calculate the cost of goods sold ( COGS ), we need to consider the changes in inventory throughout the year.

Source Image: officetimeline.com

Download Image

A company started the year with $10000 of inventory. Purchases for resale during the year were – YouTube

Mar 2, 2022answered • expert verified A company started the year with $10,000 of inventory. Purchases for resale during the year were $20,000. Inventory on December 31 is $5,000. What’s the cost of goods sold Advertisement Expert-Verified Answer question 2 people found it helpful topeadeniran2

Source Image: youtube.com

Download Image

56 Core Company Values That Will Shape Your Culture & Inspire Your Employees

Dec 30, 2022See more chevron down cgattis192 12/30/2022 Business High School verified answered • expert verified A company started the year with $10,000 of inventory. Purchases for resale during the year were $20,000. Inventory on December 31 is $5,000. What’s the cost of goods sold?$5,000$10,000$25,000$30,000$35,000 Advertisement Expert-Verified Answer

Source Image: blog.hubspot.com

Download Image

10 Best Business Card Makers + Templates – Shopify USA

Asked by ConstablePorcupineMaster845. A company started the year with $10,000 of inventory. Purchases for resale during the year were $20,000. Inventory on December 31 is $5,000. What’s the cost of goods sold?

Source Image: shopify.com

Download Image

What Is Auditing? Definition, Types & Importance

Accounting company started the year with $10,000 of inventory. Purchases for resale during the year were $20,000. Inventory on December 31 is $5,000. What is the cost of goods sold? $5000 $10000 $25000 $30000 $35000 company started the year with $10,000 of inventory. Purchases for resale during the year were $20,000.

Source Image: deskera.com

Download Image

10+ Best Places to Sell Photos Online & Make Money

What Is Auditing? Definition, Types & Importance

Dec 27, 2022Wardell Company purchased a mainframe on January 1, 2019, at a cost of $56,000. The computer was depreciated using the straight-line method over an estimated five-year life with an estimated residual value of $11,000. On January 1, 2021, the estimate of useful life was changed to a total of 10 years, and the estimate of residual value was

A company started the year with $10000 of inventory. Purchases for resale during the year were – YouTube 10 Best Business Card Makers + Templates – Shopify USA

Dec 30, 2022See more chevron down cgattis192 12/30/2022 Business High School verified answered • expert verified A company started the year with $10,000 of inventory. Purchases for resale during the year were $20,000. Inventory on December 31 is $5,000. What’s the cost of goods sold?$5,000$10,000$25,000$30,000$35,000 Advertisement Expert-Verified Answer