Does American Express Business Card Report to Personal Credit?

Applying for a business card is a common practice for entrepreneurs and business owners, offering various advantages such as expense tracking, rewards, and building a business credit history separate from personal credit. However, a common question arises: does using an American Express business card impact personal credit? Understanding this relationship is crucial for managing finances effectively and maintaining a strong credit score.

In general, American Express business cards do not directly report to personal credit bureaus such as Equifax, Experian, and TransUnion. This means that activities on an American Express business card, such as making purchases or paying bills, typically do not appear on personal credit reports. As a result, business card usage does not directly affect personal credit scores.

Business Credit vs. Personal Credit

It’s important to distinguish between business credit and personal credit. Business credit refers to the credit history and score established by a business entity, while personal credit relates to the credit history and score of an individual. American Express business cards contribute to business credit, not personal credit.

Building business credit is crucial for businesses to qualify for loans, lines of credit, and other forms of financing. By managing American Express business card payments responsibly, businesses can establish a positive business credit history, improving their borrowing capacity.

Exceptions to the Rule

While American Express business cards generally do not report to personal credit, there are some exceptions. In certain circumstances, American Express may share information about business card activity with personal credit bureaus. This can occur if:

- The business card is personally guaranteed by the business owner.

- The business card is used for personal expenses.

- There is suspected fraudulent activity on the business card.

It’s important to note that even if American Express does not report business card activity to personal credit bureaus, other factors can indirectly impact personal credit. For example, if a business owner defaults on American Express business card payments, it can damage their business credit, which in turn can affect their ability to obtain personal loans or financing.

Tips for Managing Business and Personal Credit

To effectively manage both business and personal credit, consider the following tips:

- Separate business and personal expenses: Avoid using business cards for personal expenses to prevent any potential impact on personal credit.

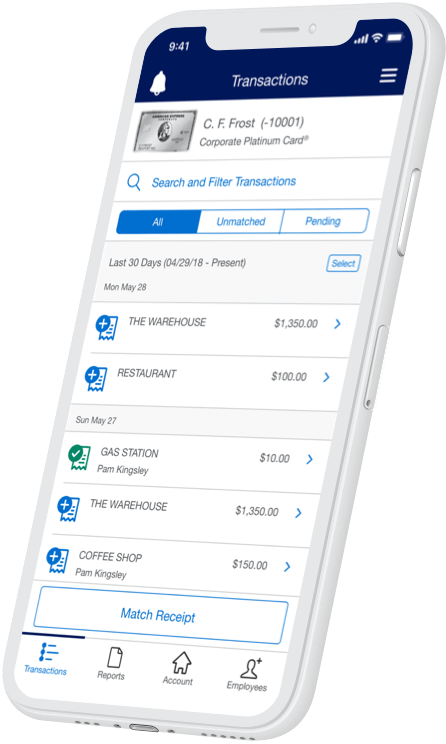

- Monitor business card activity: Regularly review American Express business card statements to ensure timely payments and avoid any unauthorized transactions.

- Build a strong business credit history: By making on-time payments and maintaining a low credit utilization ratio, businesses can establish a positive business credit history.

- Monitor personal credit reports: Periodically check personal credit reports to identify any potential issues or errors related to business card usage.

- Consider personal guarantees carefully: If a personal guarantee is required for a business card, carefully weigh the potential impact on personal credit.

FAQs

Q: Does American Express report business card activity to all personal credit bureaus?

A: No, American Express typically does not report business card activity to personal credit bureaus unless there are exceptions, such as a personal guarantee or suspected fraud.

Q: How can I improve my business credit score?

A: Make timely payments, maintain a low credit utilization ratio, and avoid unnecessary inquiries. Building business credit takes time and consistency.

Q: What happens if I default on payments for my American Express business card?

A: Defaulting on business card payments can damage business credit and make it more difficult to obtain financing. In some cases, it can also negatively affect personal credit if the business owner personally guaranteed the card.

Conclusion

American Express business cards generally do not report to personal credit, but there are some exceptions. By understanding the relationship between business and personal credit, managing credit responsibly, and following the tips outlined in this article, individuals and businesses can effectively maintain both their business and personal credit profiles.

Are you interested in learning more about how American Express business cards impact credit?

Image: www.americanexpress.com

Image: www.tiktok.com

Do Business Credit Cards Affect Your Personal Credit Score? – NerdWallet Re: Do Amex Business cards pull personal credit reports? Yes, AMEX pulls hard on your personal credit since you’re PGing the business card, but from what they told me on the phone, they will never hard pull or slash your credit report as long as you are on time with your Business card payments. Message 8 of 8. 0 Kudos.